LOTOS takes steps to develop its portfolio of concessions in Norway on a regular basis. On September 8th 2021, LOTOS Norge submitted applications in the APA licensing 2021 round. On January 18th 2022, following the conclusion of the licensing round, LOTOS Norge received an offer to participate in four of the licences applied for: PL 1135 (30% interest, Operator: PGNiG with a 70% interest), PL 1142 and PL 1143 (17.94% interest, Operator: AkerBP with a 73.01% interest) and PL 1144 (30% interest, Operator: AkerBP with a 40% interest). Three licences are located in the NOAKA project area, where LOTOS will cooperate with AkerBP. One of the areas, applied for jointly with PGNiG, is located in a part of the North Sea where the company has not yet explored for or produced hydrocarbons.

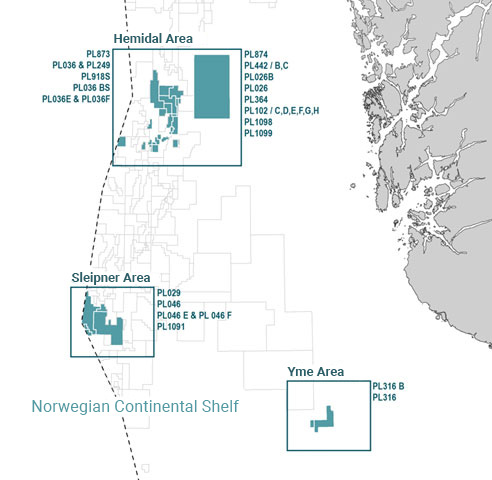

LOTOS Norge holds interests in licences covering the production infrastructure in the Heimdal and Sleipner fields, including: the Heimdal gas and condensate processing and transport hub (operated by Equinor, LOTOS Norge holds a 5% interest), and the Sleipner gas and condensate processing and transport hub (operated by Equinor, LOTOS Norge holds a 15% interest).

Gas produced from the Heimdal and the Sleipner fields is injected into the Gassled pipeline system, and then delivered to off-take points in the UK and continental Europe (the Netherlands, Germany).

Condensate from the Heimdal field is injected into the Forties Pipeline System (FPS), and then delivered to an off-take point at the Kinneil Terminal/Hound Point in Scotland, where it is processed into final products, i.e. Forties Blend crude oil and gas fractions. Condensate from the Sleipner field is transported via a pipeline to an off-take point in Karsto (Norway), where it is processed into final products, i.e. Gudrun Blend light crude and liquid fractions (NGL).

Production from the Yme field, which is in the final stages of development, will be carried out using the leased Maersk Inspirer platform. The produced crude oil will be loaded onto a tanker and transported to various off-take points, depending on crude oil parameters and market conditions.