The LOTOS Group is active in the area of building awareness of hydrogen use. LOTOS participates in the Clean Transport Package and the Ministry of Climate's work on a national hydrogen strategy. In late 2021, the government adopted the "Polish Hydrogen Strategy until 2030 with an Outlook until 2040” which aims to create a Polish hydrogen industry and its development to achieve climate neutrality and maintain the competitiveness of the Polish economy.

2021

Key results

In 2021, Grupa LOTOS S.A. earned a net profit of PLN 2,519.9 million. Operating profit was PLN 2,527.5 million (vs operating loss of PLN -1,512.5 million in 2020).

Sources of net profit earned by Grupa LOTOS S.A. in 2021 (PLNm)

In 2021, the Grupa LOTOS refinery processed 9.9 million tonnes of crude oil and the utilisation rate of its nominal refining capacity was 98.8% (i.e. close to full capacity), despite the planned cyclic maintenance shutdown, which was for the first time performed as a partial shutdown.

Crude oil throughput in Gdańsk (k tons)

2 519.9

PLN

million

Net profit

4 229

PLN

million

EBITDA LIFO

17 348

boe

/d

Average daily production of crude oil and natural gas

2.9

PLN

bn

Strong operating cash flows

A merger between PKN ORLEN and the LOTOS Group is underway to create a strong multi-utility conglomerate poised to become a major player in the European and global markets. It will be the largest merger in the fuel and energy sector in this part of the world, the starting point for a new chapter in the history of Poland and the life of these two major competitors, soon to become a single entity.

LOTOS competence centers

within the multi-utility conglomerate

Owing to the LOTOS Group’s extensive experience, Gdańsk has been selected to host the conglomerate’s hydrogen technology hub which will be created to pursue research and development projects and to integrate and coordinate all endeavors in this area. The hub’s primary focus will be to facilitate the production of green hydrogen, encourage its use for transportation purposes and develop better ways of compressing and storing it in pure form. In 2022, the Pure H2 project will enter its crucial stage. The LOTOS Group’s Green H2 project is also underway aimed at the construction of a large-scale green hydrogen production plant. In September 2021, we also initiated another hydrogen project dubbed VETNI.

The best outcomes are generated by mergers that rely on the competencies and experience of the organizations involved that are capable of making wise strategic choices. Such are the assumptions behind the merger of PKN ORLEN with the LOTOS Group and the intended structure of the future multi-utility conglomerate.

Another line of business will be base oils and lubricants. This choice has been made based on the LOTOS Group’s well-established product quality and brand recognizability in this context, supported by a well-developed sales and distribution network. Another argument is the intended execution of an investment project aimed at the production of group 2 and 3 base oils in a yet-to-be-built Hydrocracking Oil Unit. The total value of the investment project will exceed PLN 1.4 billion. Once complete, the Gdańsk refinery will produce high-quality base lubricating oils starting as early as in 2025.

The best outcomes are generated by mergers that rely on the competencies and experience of the organizations involved that are capable of making wise strategic choices. Such are the assumptions behind the merger of PKN ORLEN with the LOTOS Group and the intended structure of the future multi-utility conglomerate.

A rail logistics center will also be established in Gdańsk. LOTOS Kolej’s strong market position will be additionally reinforced by PKN ORLEN’s assets within the merged conglomerate. The LOTOS Group’s coastal location and the intended construction of a shipping terminal on the Martwa Wisła are additional major advantages. LOTOS Kolej is currently Poland’s second largest rail operator specializing in the carriage of dangerous goods.

The best outcomes are generated by mergers that rely on the competencies and experience of the organizations involved that are capable of making wise strategic choices. Such are the assumptions behind the merger of PKN ORLEN with the LOTOS Group and the intended structure of the future multi-utility conglomerate.

The fourth intended competence center will be focused on the provision of maintenance and repair services related to offshore wind energy projects in the Baltic Sea. The activities currently pursued by LOTOS Petrobaltic are aligned with these assumptions. In the context of strictly exploration and production endeavors, the leading role will be played by PGNiG, to which competencies in this area will be transferred from both LOTOS Petrobaltic and ORLEN Upstream.

The best outcomes are generated by mergers that rely on the competencies and experience of the organizations involved that are capable of making wise strategic choices. Such are the assumptions behind the merger of PKN ORLEN with the LOTOS Group and the intended structure of the future multi-utility conglomerate.

Another competence center will be focused on marine fuels. The LOTOS Group’s coastal location and extensive experience in this area argue in favor of the continued development of this business in Gdańsk. Already today, LOTOS is a direct supplier of top-quality marine fuels to all Polish ports. The Group is consistently expanding its presence in the market for low-sulfur marine fuels.

The best outcomes are generated by mergers that rely on the competencies and experience of the organizations involved that are capable of making wise strategic choices. Such are the assumptions behind the merger of PKN ORLEN with the LOTOS Group and the intended structure of the future multi-utility conglomerate.

Our

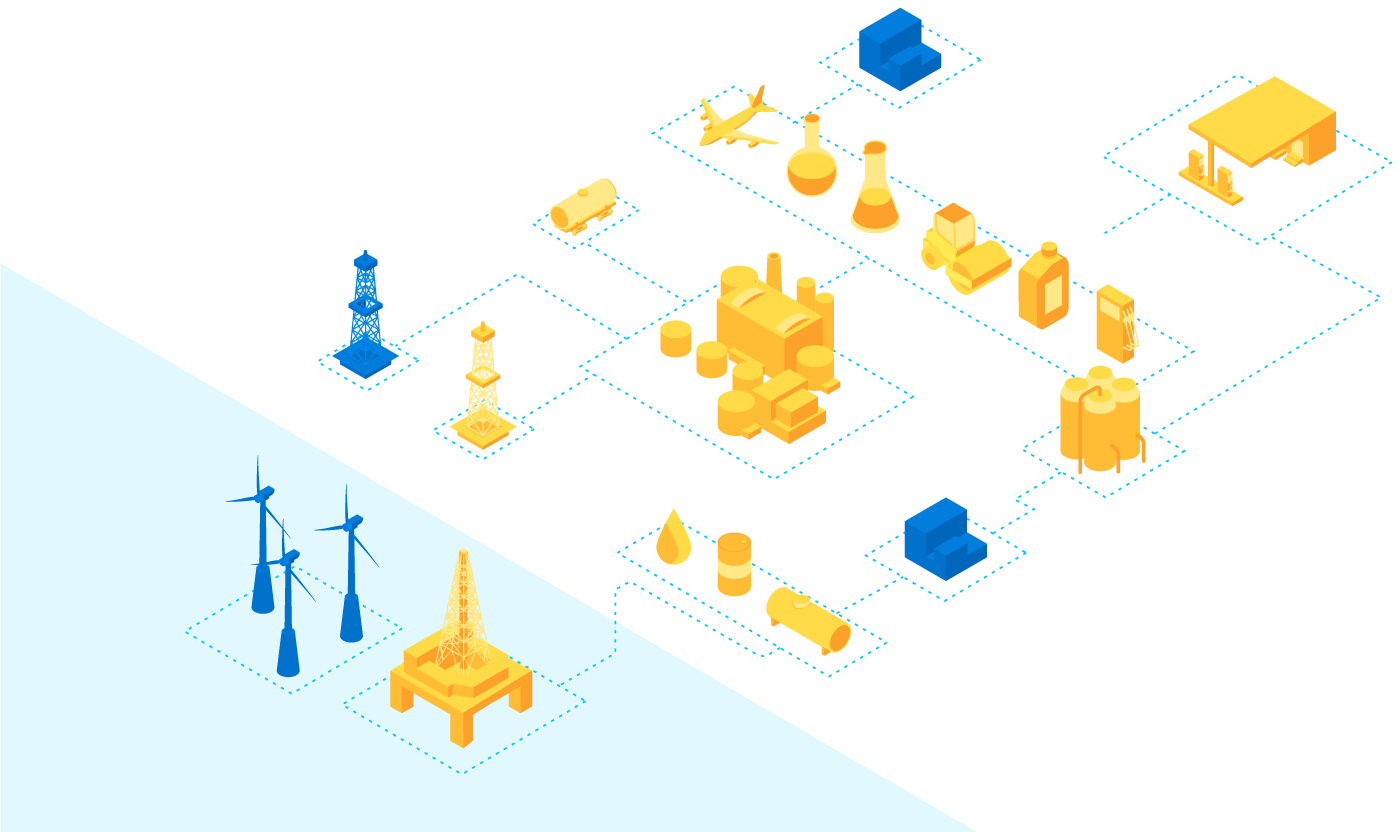

business model

The LOTOS Group is the second largest fuel producer in Poland.

The company holds a leading position in many other domestic markets, including oils, bitumens and rail freight. In addition to the production and processing of crude oil and natural gas, the Group’s business includes the sale of high-quality petroleum products and the provision of specialized logistics and maintenance services.

Offshore maintenance services

Strategic direction of development

Direct sales of the exploration and production segment to third parties

Offshore maintenance services

Strategic direction of development

Direct sales of the exploration and production segment to third parties

The LOTOS Group’s strategy takes into account sustainable development, i.e. reducing the environmental impact.